Summary

Nerdy is the leading platform for live online learning. Its flagship business, Varsity Tutors, leverages the latest technology and AI solutions to supercharge personalized live learning experiences, connecting Experts and Learners in 3,000+ subjects at scale.

Its direct-to-consumer platform, Learning Memberships, accounts for the majority of the revenue mix. This has been shifting towards its institutional product, Varsity Tutors, as schools have begun to recognize the learning gap that students are experiencing since the Covid interruptions.

Its delivery of high-dosage tutoring through an online platform at scale provides an intensive and personalized tutoring designed to enhance learning outcomes in a targeted and sustained manner.

A transition to subscription based membership from a packaged model is providing higher customer LTV (lifetime value) and strengthening gross margins.

Shifting political winds relating to education provide an opportunity for parents and legislators alike to effect significant change and reform.

Solid revenue growth, reasonable valuation, a clean balance sheet, and unusually high insider-ownership create an asymmetric opportunity to play the recent breakout.

Company Overview

Nerdy operates a curated platform that provides on-demand online tutoring and learning services, leveraging AI to transform the way people learn through technology.

The platform serves both sides of the market, connecting students, users, parents, and guardians to tutors, instructors, subject matter experts, educators, and other professionals. Its diversified business spans across nearly all levels of learning, including K-12, College, Graduate School, and Professional. It attempts to solve the scalability issue that is inherent in tutoring, and use its vast data set to connect well suited Experts and Learners.

Source: Nerdy - Transforming the Way People Learn

The personalized learning experiences available on the platform include over 3,000 subjects across multiple formats. The formats capture a wide breadth, including Learning Memberships, one-on-one instruction, small group tutoring, large format classes, tutor chat, essay review, adaptive assessments, and self-study tools.

Its flagship product, Varsity Tutors, is one of the nations largest platforms for live online tutoring and classes. Its solutions are available in two channels, direct to consumer and through education systems such as a school district or college institution.

The platform seeks to offer an opportunity to its instructors to generate income from the comfort of their own home and at their convenience, connecting them to learners who are in need of high-quality live online learning.

Operating Segments

The company reports its operations in two primary segments, Consumer (79%) and Institutional (20%). Its consumer business provides direct-to-consumer learning memberships, while the institutional side serves K-12 school districts and colleges. The institutional business has been driving growth as of late, as schools have begun to turn to alternative methods to remediate learning loss and address low student performance since the disruptions from Covid in 2020.

Many institutions have found that its students are far behind and continuing to fall further. Some of the others factors contributing to this shortfall are shortages of quality teachers, gaps in curriculum due to a fragmented educational system, and student disengagement/mental health. These worrisome trends provide meaningful tailwinds across both segments.

Competitive Positioning

The company provides two critical aspects of online learning that differentiate it from its competitors: personalized and live instruction. Synchronous and/or personalized learning tends to be much more engaging and result in a better understanding of the subject and more positive outcomes for learners.

Source: Nerdy Presentation

In the education industry, this type of instruction is known as high-dosage tutoring or high-impact tutoring. This is intensive, frequent, and personalized tutoring designed to enhance learning outcomes in a targeted and sustained manner.

Studies continuously show the benefits of high-dosage tutoring: It increases students’ learning by an additional three to 15 months across grade levels;13 moves an average student from the 50th percentile to the 66th percentile;14 and is, overall, 20 times more effective than standard tutoring models for math and 15 times more effective for reading.15 These increases in achievement show great potential for using high-dosage tutoring as a school improvement strategy. As schools continue to focus on long-term improvement of their education, implementing a high-dosage tutoring program can provide them with the tools necessary to ensure students’ academic achievement by catching knowledge gaps early, meeting students where they are, and providing evidence-based intensive recovery.

Source: Scaling Up High-Dosage Tutoring Is Crucial to Students’ Academic Success

Most of its competitors offer products in one of these categories, but rarely do they cover both well. Duolingo, for example, offers language learning completely online, but it is entirely asynchronous with no live options.

Asynchronous learning comes with significant challenges. The lack of real-time interaction with instructors and peers reduces cognitive function and lacks critical immediate feedback. Additionally, students may have difficulty maintaining motivation without a set schedule. Individuals who succeed with asynchronous learning tend to be rare, and typically have a strong self-discipline that helps them to stay on track with course material.

Finally, its AI systems and wide library of data provide another important competitive advantage that has helped to improve quality, enhance personalization, decrease cost, and achieve operational efficiency.

Source: Nerdy: Purpose-Built AI & Technology

Transition to Subscription-Based Memberships

In 2024, the company completed its transition to a recurring, subscription based membership from a packaged model, where blocks of hours or classes were sold. The membership is an all-access pass, called Learning Memberships, aimed at enhancing learning experiences by allowing students to engage with tutors more regularly and consistently. With a membership, people have ongoing access to tutoring in classes, asynchronous content, and videos and other forms of learning modalities. This same platform is the backbone of the institutional product as well.

By packaging all products together and converging the institutional and consumer platform, the company has driven customer lifetime value by 2x, subsequently expanding its gross margins by 500 basis points.

Source: Koyfin

Early observations from the company are that user behavior has begun to change meaningfully, with much more engagement from users, less friction, and wider use of a multitude of different products. Learners are experiencing a much more wholistic process, which is driving engagement across multiple subjects and stickier customer relationships.

Freemium Growing User Awareness

Recently, the company has introduced a “freemium” subscription, which the company uses to grow its user base, registering new learners and giving them access to its zero marginal cost products, such as Q&A banks or adaptive self-assessments.

Early results have showed that it does not cannibalize sales on the consumer side, as the main product is still live online. Furthermore, live-online learners tend to skew in top 10% of income, while freemium users tend to be bottom 20% income levels. This expands its market share to consumers that it may not have been able to reach.

Similarly on the institutional side, the company has found it to be a good on ramp for districts to test out the products and implement at scale easily. By offering products such as SAT and ACT and diagnostic testing in K-12 subjects aligned to state standards, they build credibility and trust with districts. From this point, it puts them in a position to make districts aware of any needs related to high-dosage tutoring.

Opportunities and Risks with Shifting Political Winds

The cultural and political winds seem to be shifting as parents take a closer look at their children’s development, both at the institutional level and in the home. In institutions, parents are especially beginning to take issue with the values being purported at schools, and have realized that a hands-off approach to their child’s education has left their kids development at the whims of a weak education system. Additional scrutiny on the education system is providing a moment for legislators to address the issue, opening a window for reform that could dramatically alter the education ecosystem.

Vivek Ramaswamy had a recent post in this same vein on X that gained significant traction, he wrote:

The reason top tech companies often hire foreign-born & first-generation engineers over “native” Americans isn’t because of an innate American IQ deficit (a lazy & wrong explanation). A key part of it comes down to the c-word: culture. Tough questions demand tough answers & if we’re really serious about fixing the problem, we have to confront the TRUTH:

Our American culture has venerated mediocrity over excellence for way too long (at least since the 90s and likely longer). That doesn’t start in college, it starts YOUNG.

A culture that celebrates the prom queen over the math olympiad champ, or the jock over the valedictorian, will not produce the best engineers…

…More movies like Whiplash, fewer reruns of “Friends.” More math tutoring, fewer sleepovers. More weekend science competitions, fewer Saturday morning cartoons. More books, less TV. More creating, less “chillin.” More extracurriculars, less “hanging out at the mall.”

Most normal American parents look skeptically at “those kinds of parents.” More normal American kids view such “those kinds of kids” with scorn. If you grow up aspiring to normalcy, normalcy is what you will achieve.

Services like Nerdy provide an all-in-one platform for parents to replace doom-scrolling on Tik Tok with powerful educational resources that can be engaging for students, and provide better long-term outcomes.

On the funding side, it is not clear if a budget cut or dissolution of the Department of Education would be a net positive or negative for Nerdy. As of now, Nerdy receives around 20% of its revenues from institutions, but it is a meaningful source of top-of-funnel marketing. If federal or state funding for public schools is reduced, schools may have fewer resources to provide supplemental tutoring or educational programs. This could create more demand for private tutoring services like those offered by Nerdy as parents seek supplemental learning tools, online tutoring, and after-school programs. Some of the cuts could affect educational grants or partnerships that schools, districts, or other educational organizations have with companies like Nerdy, but I believe that high-impact programs like tutoring would be set aside from funding cuts because of the depth of research backing it.

Furthermore, if public education faces deepening challenges, there may be a broader trend toward alternative education solutions, such as online platforms or independent learning centers. There seems to be a reignition of alternative solutions already, as more families consider homeschooling due to lack of quality public schools in their area. This may provide for new and expanding products and services to address these needs.

What are School Districts Saying About Nerdy?

Earlier this week, Winton Woods City School District, announced a partnership with Nerdy to provide live and on-demand tutoring resources for its students through Varsity Tutors. Winton Woods City is a large school district in Ohio, with 6 schools and over 3,800 students.

The district’s Executive Director of Teaching and Learning, Dr. Tamra Ragland, released the following statement along with its public announcement of the partnership.

“We are grateful for our partnership with Varsity Tutors. It is an invaluable resource that both students and staff can use in and out of the classroom, ….from free SAT prep and career planning courses to FAFSA guidance and final exam reviews across all subjects, it offers far more than homework help. It’s a great product with features and translates into 100 languages and accounts for all teachers. This platform delivers immense value - all at no cost to our families. It’s a partnership we’re truly grateful for.”

Financials

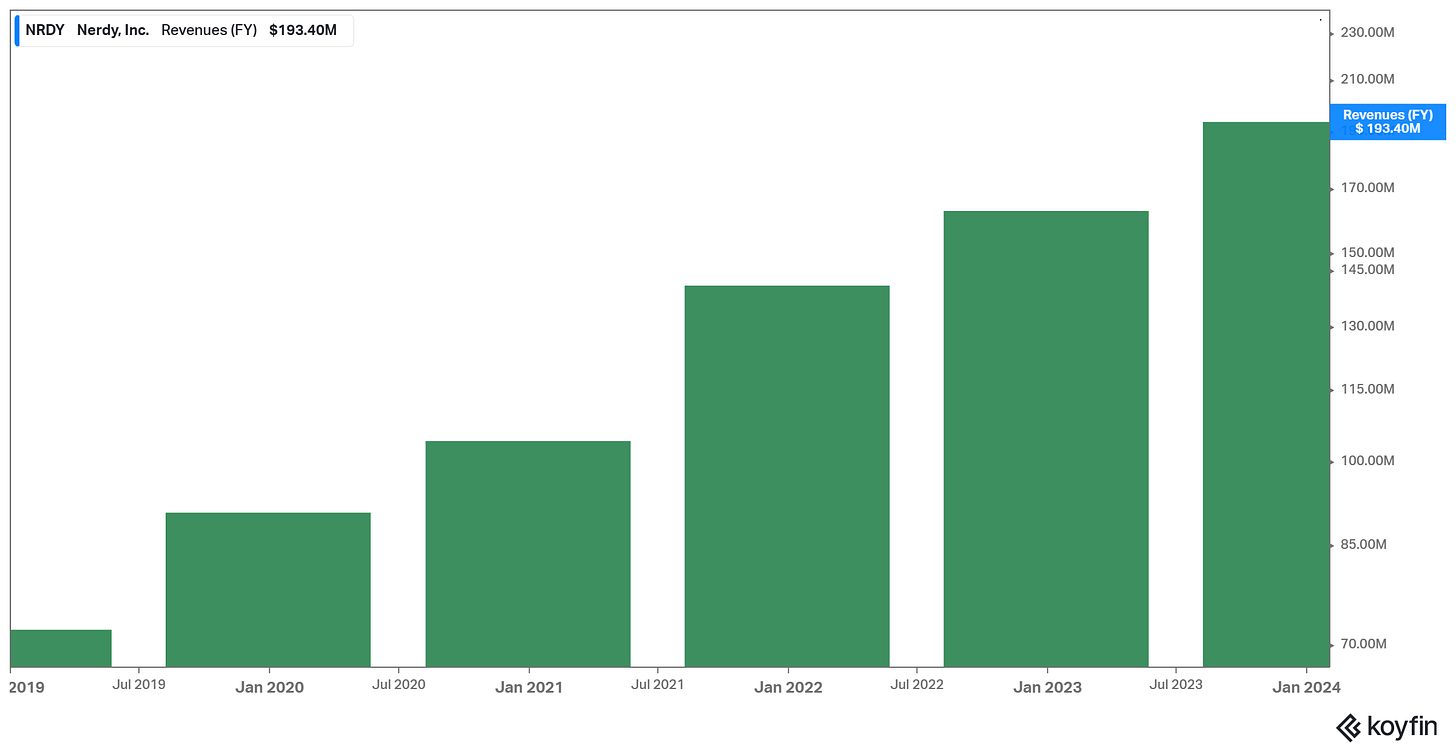

Top line growth has been strong for the company historically..

Source: Koyfin

..but is expected to slow slightly for this year, and reaccelerate into 26’ as the company realizes returns from its investments into development of its Learning Memberships platform.

Source: Koyfin

The company is focusing on funding growth internally, with an eye towards being adjusted EBITDA positive by 26’.

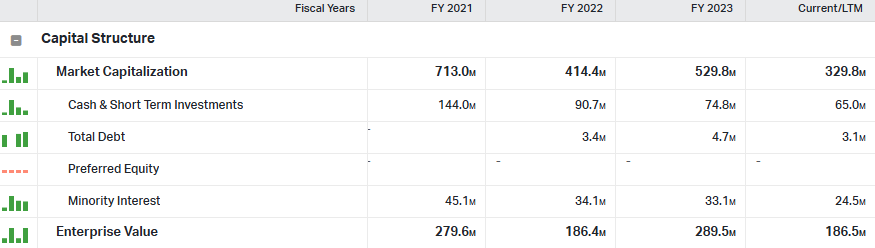

Nerdy currently has around $65 million in cash on its balance sheet, with almost no debt, giving it plenty of flexibility and liquidity. Its strong financial position should give it a steady path forward to continue growing with internal capital and hit its growth targets.

Source: Koyfin

Looking at the stocks valuation relative to a three-year lookback, its still trading low on a P/S basis and EV/Gross Profit, but not at rock bottom levels as it was mid-to-late last year.

Source: Koyfin

Trading just over 1x sales versus its peer group at 1.8x, its clear that the market has yet to appreciate its transition to the subscription based model, which should give it more predictability in its revenues and pull its valuation higher.

Source: Koyfin, Zuiderwind Research

Management & Insider Ownership

Chuck Cohn - Founder, Chairman & CEO

Mr. Cohn is the Founder, Chairman & CEO of Nerdy. He founded the company in 2007 during college after experiencing frustration finding the personalized help he needed for a calculus course. He spent his early career working as an investment banker at Wells Fargo Securities (Wachovia) and healthcare private equity at Ascension Ventures, an $800M AUM private equity fund. Chuck bootstrapped Nerdy before leaving his private equity role to focus on growing Nerdy full-time at the end of 2011.

Mr. Cohn has significant holdings of the company, owning around 48% of shares outstanding. He has recently acquired a large stake of that, almost $10 million worth, just in 2024.

Jason Pello - CFO

Mr. Pello is the Chief Financial Officer, responsible for the Nerdy’s FP&A, Accounting, and Treasury functions. He has 18 years of experience in Finance and Accounting. Prior to joining Nerdy, Jason served as Vice President - Corporate FP&A at SAVE-A-LOT, a $4 billion revenue grocery chain owned by private equity. Prior to that role, Jason served in various senior financial roles at Caleres (formerly Brown Shoe Company) and Peabody Energy.

Mr. Pello’s ownership of the company is less impressive, with around 2% of the company shares outstanding.

All together, managements and insiders own nearly 80% of the company, which aligns them well with shareholders.

Source: Factset, Zuiderwind Research

How I’m Trading the Breakout

Nerdy broke out of its 100-day range on strong volume back on December 16th, 2024. This was after a nearly 140% move off the bottom in only 24 trading days. The stock was due for a pullback, and has bounced nicely off of the support near the $1.55 level after the news broke of its partnership with the large, Ohio school district that I discussed earlier.

I entered a small position the day after the breakout, on December 17th, but plan on adding on the open tomorrow after holding the $1.50 level well over the last week. I would rather get ahead of the break above $2 as I expect that could be the technical catalyst for the next up leg, if it were to happen. I’m setting a stop 30% below the close today, which gives some room for stops to get jammed around the $1.40 level on a technical shakeout.

As always, nothing I say is investment advice, please seek advice from an investment professional on your unique situation. The writing is for informational and educational purposes only, and is not an offer to buy or sell securities mentioned. I may hold positions long or short in securities mentioned, and positions are often a small percentage of my overall portfolio. I will not be writing in a regular, predictable basis, please do your own due diligence on any topics mentioned.